If those are not enough, here’s a recent presentation I made about tax reform for Argentina’s Fundacion Internacional Bases.

I was one of three speakers and I encourage everyone to watch the entire one-hour program.

My role was to explain the three main features of the flat tax.

- A low tax rate on productive economic behavior.

- No double taxation of income that is saved and invested.

- Elimination of unfair and corrupt loopholes.

I’ve written many times on all of those topics, especially the first two.

So, for today’s column, let’s focus on the third point.

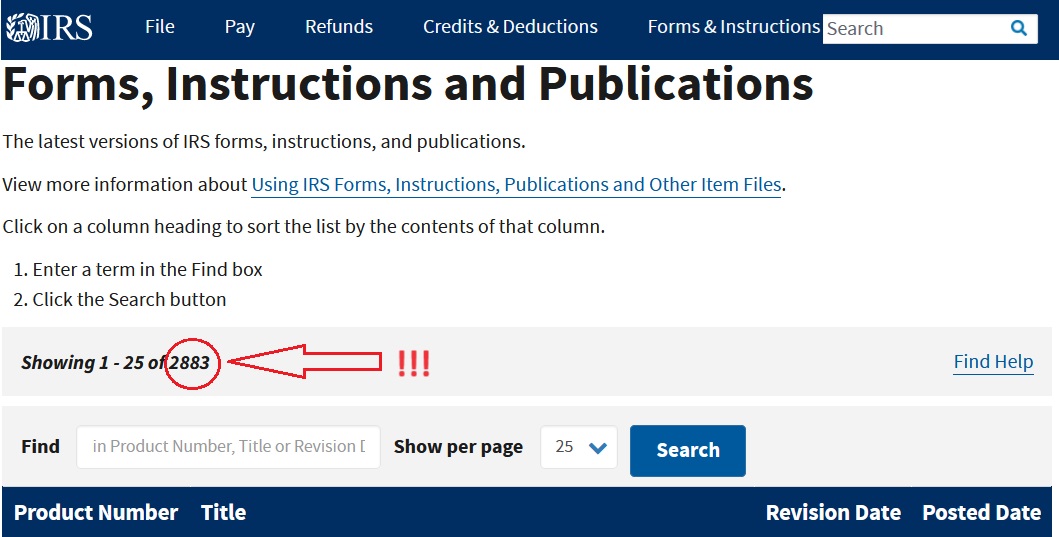

And I don’t even need to do a lot of writing because the most persuasive evidence about our complicated and unfair tax code can be found on this IRS webpage.

By the way, I wrote “theoretically” because many taxpayers have no idea whether they are accurately complying. The tax code is too much of a Byzantine mess.

As an economist, I want a flat tax so we can enjoy faster growth.

As a human being, I want a simple system to get rid of unfairness and complexity.

P.S. Sadly, some folks on the left don’t understand the flat tax.

February 5, 2024 by Dan Mitchell